The Benefits Of Updating My W-4 For 2024 – The key to paying the right amount of tax is to update your W-4 regularly and reverse many tax benefits. If you fail to account for these events on your W-4, your withholdings could be . The IRS taxes the Social Security benefits of some seniors as well. Here are four things all beneficiaries ought to know before filing their taxes this year. Twelve states Social Security .

The Benefits Of Updating My W-4 For 2024

Source : www.nerdwallet.comW 4: Guide to the 2024 Tax Withholding Form NerdWallet

Source : www.nerdwallet.com2024 New Federal W 4 Form | What to Know About the W 4 Form

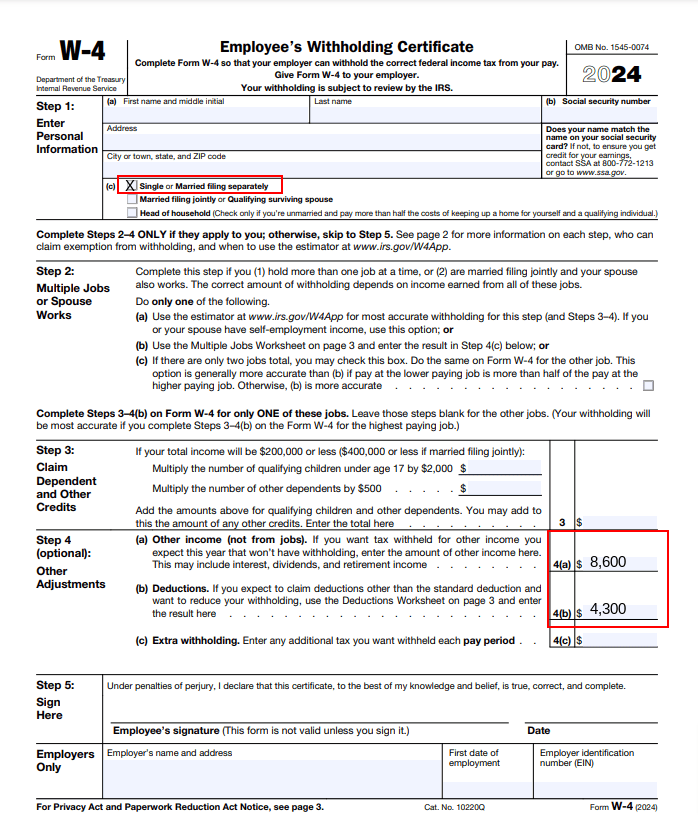

Source : www.patriotsoftware.comEmployee’s Withholding Certificate

Source : www.irs.govPublication 505 (2023), Tax Withholding and Estimated Tax

2024 Form W 4P

Source : www.irs.govHow to Fill Out the W 4 Form (2024) | SmartAsset

Source : smartasset.com2024 New Federal W 4 Form | What to Know About the W 4 Form

Source : www.patriotsoftware.comHinsdale Living

Source : www.facebook.comGuide to Additional Amount Withheld and Form W 4 | Indeed.com

Source : www.indeed.comThe Benefits Of Updating My W-4 For 2024 W 4: Guide to the 2024 Tax Withholding Form NerdWallet: Most folks have their tax payments automatically deducted from their paychecks by their employers, but sometimes, a tax bill shows up when they file their return anyway. Here are a few possible . For millions of Americans, there is no getting around the need to file an annual tax return. In most cases the earlier you get it done, the better off you’ll be. “The IRS encourages people to .

]]>